Tax compliance and practice management are crucial to running a successful accounting or tax practice. Managing client information, deadlines, and documents can be overwhelming and time-consuming. This article explores TaxDome, a comprehensive tax practice management platform designed to simplify tax-related processes, enhance productivity, and provide a seamless experience for practitioners and clients.

What is TaxDome?

TaxDome is a cloud-based platform for tax and accounting professionals to streamline their practice management. It combines advanced technology with powerful features to offer a comprehensive solution for tax preparation, document management, client communication, and workflow automation.

In today’s digital age, accountants and tax professionals need efficient solutions that streamline their workflow, improve client collaboration, and ensure compliance. TaxDome allows practitioners to efficiently manage their clients, deadlines, tasks, and documents in one centralized location.

Recommendations and Ratings

EXPERT RECOMMENDATIONS

Overall

-

Easy-of-Use - 85

-

Feature and Functionality - 90

-

Customer Support - 90

-

Setup and Integration - 75

-

Value of Money - 85

User Review

4.35 (26 votes)Key Features and Functionalities of TaxDome

TaxDome offers a range of features and functionalities that simplify tax practice management. Let’s explore some of its key offerings.

Client Management

It provides a centralized hub for managing client information, including contact details, engagement history, and document storage. It allows practitioners to easily add new clients, categorize them based on their tax needs, and track their progress throughout the tax season.

Document Management

The platform enables practitioners to store, organize, and share documents with clients securely. With TaxDome’s document management feature, practitioners can upload tax forms, financial statements, and other relevant documents, eliminating the need for physical paperwork and reducing the risk of document loss.

Workflow Automation

It automates repetitive tasks and workflows, reducing manual effort and saving time. It offers customizable templates for engagement letters, questionnaires, and other client communications. Practitioners can set up automated reminders for deadlines, send notifications to clients, and track task progress to ensure timely completion.

Secure Client Portal

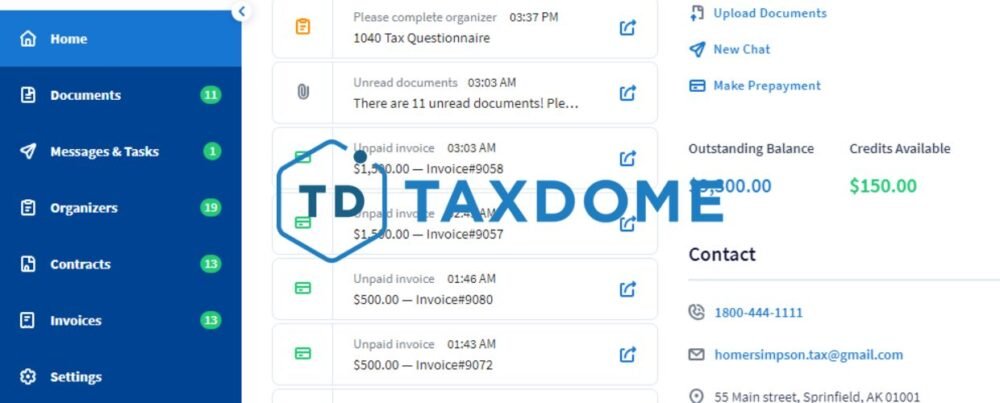

TaxDome provides a secure client portal that facilitates seamless communication between practitioners and clients. Clients can securely upload and access their documents, review completed tax returns, communicate with their assigned practitioner, and make payments, all within a secure online environment.

E-Signature Integration

The platform integrates with electronic signature solutions, allowing practitioners to send tax documents to clients for e-signature. It eliminates the need for physical document exchange and speeds up the signing process, ensuring efficient and secure document handling.

Benefits of TaxDome

Implementing TaxDome can benefit tax professionals and accounting firms seeking to streamline their tax practice management. Let’s explore some of these benefits.

Enhanced Productivity

By automating tasks and workflows, TaxDome frees up practitioners’ time, allowing them to focus on higher-value activities. The platform’s streamlined document management and automated reminders ensure efficient client collaboration and reduce administrative overhead.

Improved Client Collaboration

Its client portal fosters seamless communication and collaboration between practitioners and clients. Clients can securely access their documents, communicate with their assigned practitioners, and track the progress of their tax preparation. It improves transparency, strengthens client relationships, and increases client satisfaction.

Compliance and Security

TaxDome prioritizes data security and compliance with industry regulations. The platform employs robust security measures, including data encryption, secure document storage, and access controls. Practitioners can confidently handle sensitive client information, knowing their data is protected.

Streamlined Document Management

Its document management feature allows practitioners to organize and store client documents in a centralized and secure location. It eliminates the need for physical storage and effectively reduces the risk of document loss or misplacement. Practitioners can quickly retrieve documents when needed, improving efficiency and reducing administrative errors.

Scalability and Flexibility

The platform caters to practices of all sizes, from sole practitioners to large accounting firms. The platform’s scalability and flexibility allow practitioners to adapt their tax practice management to their needs. Whether handling a few clients or a high volume of tax returns, TaxDome can accommodate the changing demands of the practice.

Conclusion

TaxDome is a comprehensive tax practice management platform that simplifies tax-related processes, enhances productivity, and improves client collaboration for accountants and tax professionals. With its powerful features, such as client management, document management, workflow automation, secure client portal, and e-signature integration, the platform streamlines practice management, reduces administrative burden, ensures compliance and data security, and improves overall efficiency. By implementing TaxDome, tax professionals can focus on providing high-quality services, fostering stronger client relationships, and achieving tremendous success in their tax practices.