In the financial industry, effective client engagement is crucial for business success. PreciseFP, an innovative financial data management platform, empowers financial professionals to streamline client interactions and optimize engagement strategies. This article explores the key features, functionalities, and benefits of PreciseFP, highlighting its significance in driving authentic and personalized client experiences.

What is PreciseFP?

PreciseFP is a cutting-edge platform enabling financial professionals to harness the power of data to enhance client engagement. Unlike traditional client management systems, the platform offers advanced features that allow financial advisors to collect, organize, and leverage financial data precisely and efficiently.

By utilizing PreciseFP’s intuitive technology, financial professionals can optimize client interactions, gain valuable insights, and deliver tailored experiences that cater to their client’s unique financial needs. Financial professionals using the platform can achieve improved client satisfaction, increased efficiency, enhanced compliance, and data-driven strategies.

Recommendations and Ratings

EXPERT RECOMMENDATIONS

Overall

-

Easy-of-Use - 85

-

Feature and Functionality - 85

-

Customer Support - 95

-

Setup and Integration - 80

-

Value of Money - 85

User Review

5 (1 vote)Key Features and Functionalities of PreciseFP

PreciseFP encompasses a range of powerful features and functionalities that enable financial professionals to manage and leverage financial data for superior client engagement effectively. Some of its features and functionalities are discussed below.

Secure Data Collection and Organization

It provides a secure and user-friendly interface that allows financial professionals to collect and organize client financial data seamlessly. The platform offers customizable forms and questionnaires, enabling advisors to gather specific information tailored to their client’s financial goals and objectives. Users can securely store and quickly access those data when needed, streamlining the advisory process.

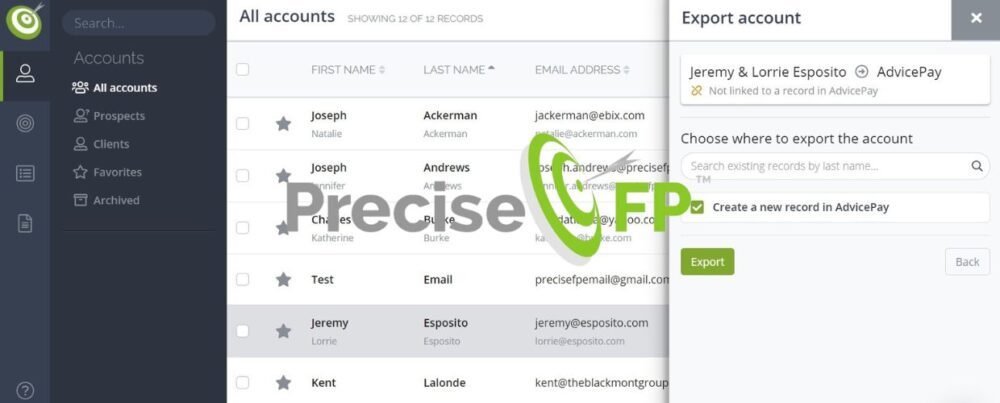

Integration with Financial Tools and CRMs

PreciseFP seamlessly integrates with various financial tools and customer relationship management (CRM) systems, providing financial professionals with a centralized hub for data management. Integration capabilities allow advisors to synchronize client data across multiple platforms, ensuring consistency and eliminating manual data entry tasks. This integration enhances operational efficiency and provides a comprehensive view of client information, empowering advisors to make informed decisions.

Automated Workflows and Client Communication

The platform offers automated workflows and communication features that simplify and enhance client interactions. Financial professionals can create customized workflows to automate repetitive tasks, such as data collection and follow-up communications. This automation frees up valuable time for advisors to focus on building stronger client relationships and providing personalized financial guidance.

Advanced-Data Analysis and Reporting

PreciseFP provides robust data analysis and reporting capabilities, allowing financial professionals to gain actionable insights from client data. The platform offers robust reporting tools that generate comprehensive reports on client financial profiles, goals, and preferences. These insights enable advisors to tailor their advice, offer relevant financial solutions, and make data-driven recommendations to help clients achieve their financial objectives.

Regulatory Compliance and Data Security

It prioritizes regulatory compliance and data security, protecting client information. The platform adheres to industry standards and employs advanced security measures to safeguard sensitive financial data. By maintaining compliance with regulations such as the General Data Protection Regulation (GDPR) and the Securities and Exchange Commission (SEC) requirements, financial professionals can build trust with clients and demonstrate their commitment to data privacy.

Benefits of PreciseFP

PreciseFP offers a range of benefits that empower financial professionals to excel in client engagement and drive business growth—some of its benefits are below.

Personalized Client Experiences

By leveraging the power of financial data, PreciseFP enables financial professionals to deliver personalized client experiences. Advisors can gather detailed information about clients’ financial goals, risk tolerance, and preferences, allowing for tailored advice and customized financial solutions. This personalized approach enhances client satisfaction, fosters trust, and strengthens long-term relationships.

Improved Operational Efficiency

PreciseFP streamlines client data management processes, reducing administrative overhead and improving operational efficiency. With automated workflows, data integration, and streamlined communication, financial professionals can focus more on high-value activities such as client relationship building, financial planning, and providing strategic advice. This increased efficiency allows advisors to serve more clients effectively.

Enhanced Compliance and Data Security

Its robust compliance features and data security measures ensure financial professionals adhere to regulatory requirements and safeguard client information. By maintaining compliance, financial advisors build credibility and trust with clients, reinforcing the confidentiality and integrity of their data. This commitment to security strengthens client relationships and protects the reputation of financial advisory practices.

Data-Driven Decision-Making

Through advanced data analysis and reporting capabilities, PreciseFP equips financial professionals with valuable insights to make informed decisions. Advisors can identify trends, analyze client preferences, and track progress toward financial goals. This data-driven approach enhances strategic decision-making, enabling advisors to provide proactive financial guidance and offer suitable investment recommendations.

Future-Proof Client Engagement

PreciseFP places financial professionals for long-term success by adapting to evolving client engagement strategies. The platform’s flexible architecture seamlessly integrates emerging technologies and data sources. As client expectations and industry trends change, the platform empowers financial professionals to stay ahead by leveraging new tools, data analytics techniques, and client communication channels.

Conclusion

PreciseFP is a game-changing platform that revolutionizes client engagement in the financial industry. By leveraging advanced data management and analysis capabilities, financial professionals can provide precise and personalized experiences that meet clients’ unique financial needs. With secure data collection, integration with financial tools, automated workflows, and robust reporting, the platform enhances operational efficiency, regulatory compliance, and decision-making. PreciseFP unlocks the true potential of economic data, empowering advisors to excel in client engagement and drive business success in the digital era.