Keeping track of expenses and receipts can take time and effort in personal finance management. This article explores Pixie, an innovative expense management solution designed to simplify the process of tracking expenses, organizing receipts, and gaining insights into spending habits.

What is Pixie?

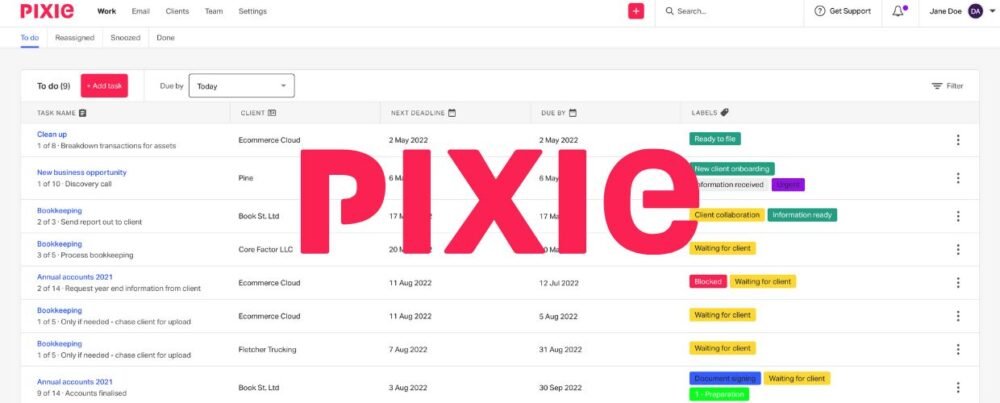

Pixie is a user-friendly expense tracking and receipt management platform that helps individuals effortlessly stay on top of their expenses. With its intuitive interface and advanced features, the platform streamlines the process of recording expenses, capturing receipts, and categorizing transactions. It serves as a digital wallet for receipts, eliminating the need for paper receipts and providing individuals with a centralized hub to manage their spending.

Pixie comes to the rescue to alleviate the burden of financial management and provide individuals with an efficient solution for expense tracking and receipt management. The platform is the go-to solution for individuals seeking a user-friendly and efficient platform to simplify expense tracking and receipt management, ultimately contributing to better financial health and peace of mind.

Recommendations and Ratings

EXPERT RECOMMENDATIONS

Overall

-

Easy-of-Use - 90

-

Feature and Functionality - 90

-

Customer Support - 95

-

Setup and Integration - 90

-

Value of Money - 90

User Review

4.58 (24 votes)Key Features and Functionalities

Pixie offers a range of features and functionalities that make expense tracking and receipt management a breeze. Let’s delve into some of its key offerings.

Expense Tracking

It allows users to record expenses on the go. Users can manually input transactions or link their bank accounts and credit cards to import transactions automatically. The platform categorizes expenses based on customizable categories, making it easy to identify spending patterns and track where the money goes.

Receipt Capture and Organization

With Pixie, users can capture digital receipts using their smartphone camera. The platform utilizes OCR (Optical Character Recognition) technology to extract relevant receipts information. Users can then categorize and tag receipts for easy retrieval. This feature eliminates the need for paper receipts and reduces clutter, making managing and storing receipts digitally convenient.

Real-time Spending Insights

The platform provides users with real-time insights into their spending habits. The platform generates visualizations and reports that depict spending patterns, highlight areas of high expenditure, and compare spending across different categories. These insights empower individuals to make informed decisions about their spending and identify opportunities for saving.

Budgeting and Alerts

Pixie allows users to set budgets for different expense categories. The platform sends alerts and notifications when users approach or exceed their budget limits. This feature helps individuals stay on track with their financial goals, control spending, and avoid overspending.

Expense Reports

It simplifies the process of generating expense reports. Users can create customized expense reports with just a few clicks. The platform automatically populates the report with categorized transactions and attached receipts. It streamlines the reporting process, making it easier for individuals to track and share their expenses with employers, accountants, or for reimbursement purposes.

Integration with Accounting Software

Pixie integrates seamlessly with popular accounting software, such as QuickBooks and Xero. This integration allows users to sync their expense data with their accounting systems, streamlining the process of reconciling expenses, simplifying tax filings, and ensuring accurate financial records.

Benefits of Pixie

Implementing Pixie can benefit individuals seeking to streamline their expense tracking and receipt management. Let’s explore some of these benefits.

Time and Effort Savings

The platform simplifies the process of expense tracking and receipt management, saving individuals valuable time and effort. With automated transaction imports, receipt capture, and categorization, users can efficiently manage their expenses without manual data entry or organizing paper receipts.

Financial Awareness

By providing real-time insights into spending habits, Pixie enhances financial awareness. Users can visualize their expenses, identify areas of overspending, and make adjustments to align their spending with their financial goals. This increased awareness enables individuals to make informed financial decisions and work towards better financial health.

Improved Expense Management

Its intuitive interface and organization feature help individuals efficiently manage their expenses. Categorization, tagging, and easy retrieval of digital receipts simplify expense tracking and facilitate expense management. Users can access their expense data anytime, anywhere, ensuring a clear overview of their financial transactions.

Enhanced Budgeting

Pixie’s budgeting features enable users to set and monitor budgets for different expense categories. By receiving alerts and notifications when approaching budget limits, individuals can exercise better control over their spending and work towards achieving their financial goals.

Seamless Integration

Its integration with popular accounting software provides seamless synchronization of expense data. This integration ensures accurate financial records, simplifies tax filings, and streamlines the accounting process.

Conclusion

Pixie revolutionizes the way individuals track expenses and manage receipts. With its intuitive interface, expense tracking capabilities, receipt organization, real-time spending insights, budgeting features, and seamless integration with accounting software, the platform simplifies expense management and enhances financial awareness. By implementing Pixie, individuals can save time, gain better control over their expenses, make informed financial decisions, and work towards achieving financial goals.