In today’s complex and ever-changing business landscape, regulatory risk has become a critical consideration for organizations across various industries. Regulatory risk refers to the potential impact of changes in laws, regulations, and government policies on businesses. Failure to understand and manage regulatory risk can result in severe consequences, including legal penalties, reputational damage, and financial losses. This article will delve into regulatory risk, its impact on businesses, and strategies for effectively managing and mitigating it.

Understanding Regulatory Risk

Regulatory risk encompasses the uncertainties and challenges arising from changes in the regulatory environment. These changes can be at the local, national, or international level and may include new laws, regulations, licensing requirements, compliance standards, or shifts in government policies. Regulatory risk can affect organizations in various ways, such as:

Compliance Obligations

Regulatory changes often impose new compliance obligations on businesses. Organizations must ensure their operations, processes, products, and services align with the updated requirements. Failure to comply can result in fines, legal actions, or the revocation of licenses or permits.

Operational Disruptions

Regulatory changes can disrupt existing business operations. Organizations may need to modify their systems, processes, or supply chains to meet the new standards. It can lead to increased costs, delays, and potential interruptions in service delivery.

Reputational Damage

Non-compliance with regulations can severely damage a company’s reputation. Negative publicity, loss of customer trust, and a tarnished brand image can have long-lasting consequences, impacting the organization’s market position and customer base.

Financial Implications

Regulatory risk can have significant financial implications. Compliance costs, fines, penalties, and legal expenses can erode profitability and strain financial resources. Additionally, regulatory changes may require additional investments or impact revenue streams, potentially leading to financial losses.

Managing Regulatory Risk

Effectively managing regulatory risk is crucial for organizations to ensure compliance, protect their reputation, and maintain financial stability. Here are some strategies for managing and mitigating regulatory risk:

Stay Informed

Organizations must stay informed about regulatory changes that impact their industry and operations. It includes monitoring legislative updates, government announcements, and industry publications, as well as engaging with regulatory bodies and industry associations. Establishing a dedicated compliance team or hiring legal experts can help organizations stay informed and interpret the impact of regulatory changes.

Conduct Risk Assessments

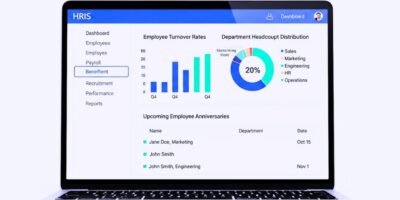

Regularly assess and analyze the potential impact of regulatory changes on the organization. Identify areas of vulnerability, evaluate compliance gaps, and develop mitigation strategies to address potential risks. It may involve conducting internal audits, risk assessments, and implementing robust compliance management systems.

Establish Compliance Programs

Develop comprehensive compliance programs that align with regulatory requirements. It involves implementing policies, procedures, and internal controls to ensure compliance with regulations. Train employees on compliance obligations, ethical conduct, and reporting mechanisms. Encourage a culture of compliance throughout the organization.

Engage with Regulators

Foster a proactive relationship with regulatory authorities. Establish open lines of communication, participate in industry consultations, and seek clarification on regulatory requirements when needed. Engaging with regulators can help organizations better understand the intent behind regulations, address concerns, and influence policy-making processes.

Monitor and Update

Continuously monitor regulatory developments and assess their impact on the organization. Regularly review and update compliance programs to ensure they remain relevant and effective. Establish mechanisms for ongoing compliance monitoring, reporting, and internal audits to detect and address potential issues proactively.

Seek Legal Advice

In cases of complex regulatory requirements or uncertainties, seek legal advice from experts in the relevant field. Legal professionals can provide guidance on compliance strategies, help navigate regulatory frameworks, and ensure that the organization’s actions align with legal obligations.

Foster a Compliance Culture

Promote a culture of compliance throughout the organization. Encourage employees to report potential compliance issues or breaches through designated channels without fear of retaliation or retribution. Implement whistleblower protection policies to safeguard employees who raise genuine concerns.

Conclusion

Regulatory risk is an inherent aspect of business in a dynamic regulatory landscape. Organizations must recognize the impact of regulatory changes on their operations, compliance obligations, reputation, and financial stability. Companies can effectively manage and mitigate regulatory risks by staying informed, conducting risk assessments, establishing compliance programs, engaging with regulators, and fostering a culture of compliance. Proactive management of regulatory risk ensures legal compliance and enhances operational efficiency, protects the organization’s reputation, and positions it for sustainable growth in a complex regulatory environment.